GL System Options

Updated March 16, 2022

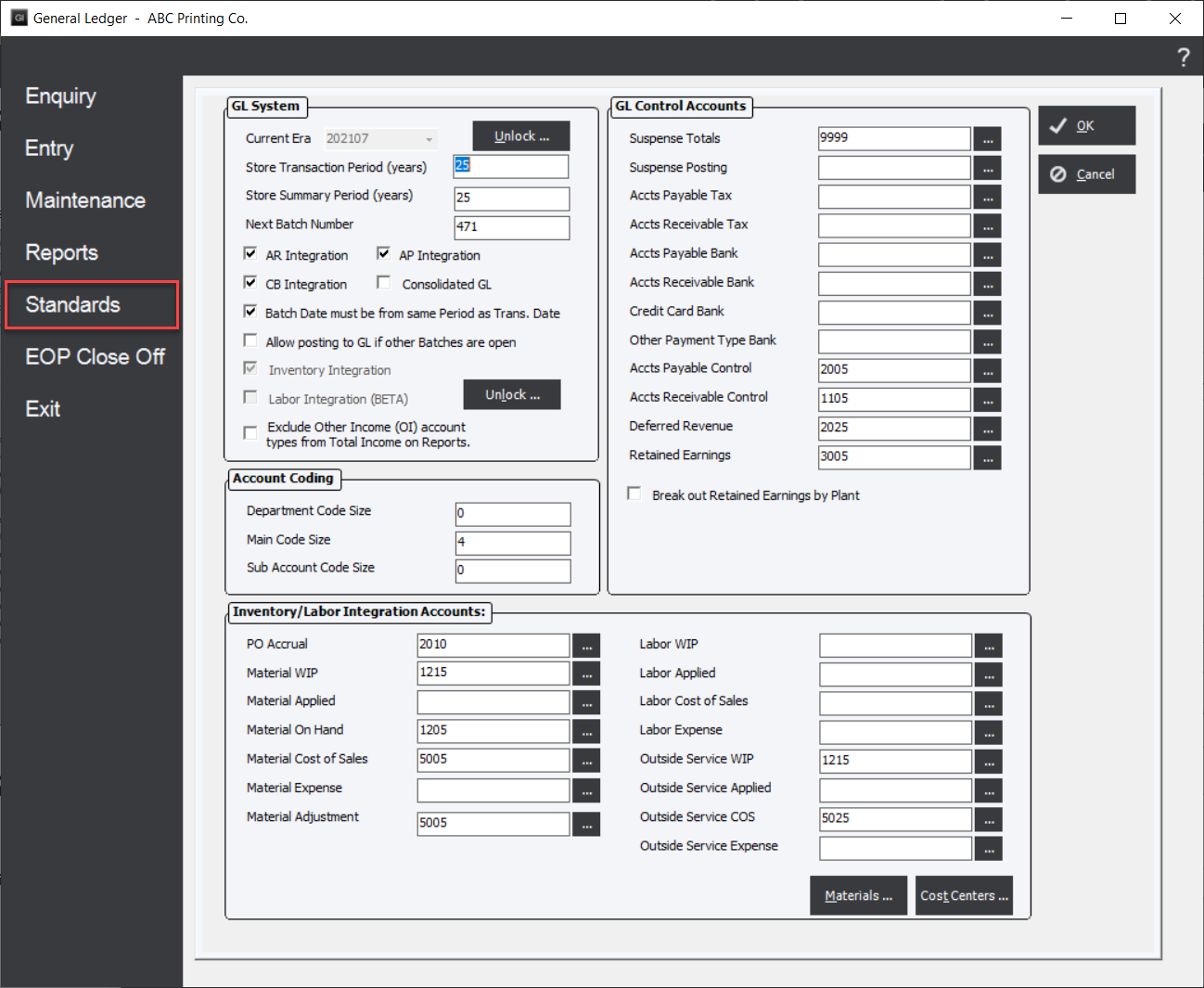

The user will want to set options for the General Ledger Module. To do this select menu option Standards/GL System. The system will display the "GL System" screen.

GL System Screen

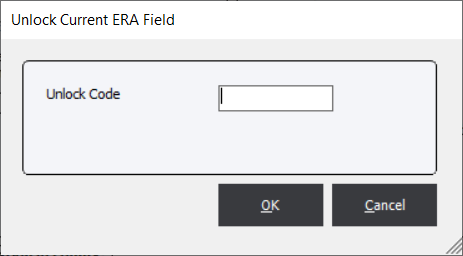

Current Era : This field will display the Era for the current month of the financial year. For example, if the current month is February, 2022, then the Current Era would be 202202. Once set it will be automatically maintained by the system. Note that the field will be disabled. If for some significant reason the Current Era must be revised (highly unusual), the user will be required to contact EPMS for an "Unlock" code.

Unlock (Button) : Use the "Unlock" feature to revise the current Era. The system will display the "Unlock Current ERA Field" screen. The user will be required to contact EPMS for the code.

Store Transaction Period : This field will define the number of years that the system will retain General Ledger transactions. At year end rollover, the system will delete appropriate records. The system will not, however, delete reconciled transactions.

Store Summary Period : This field will define the number of years that the system will retain General Ledger Summary Period records. The Summary Period table will contain monthly totals for all accounts The system will delete appropriate records only at year end rollover.

Next Batch Number : The system will assign the number to the next Batch to be created.

AR Integration (Option) : If selected, the system will automatically create Journals whenever an Accounts Receivable batch is posted.

CB Integration (Option) : If selected, the system will automatically create Journals whenever Cashbook batch is posted.

AP Integration (Option) : If selected, the system will automatically create Journals whenever an Accounts Payable batch is posted.

Consolidated GL (Option) : This option will apply if the user is operating separate companies and would like to generate a consolidated General Ledger. If this is desired, the user is encouraged to contact EPMS support for additional information.

Labor Integration (Option) : If selected, the system will allow access to the "Labor Integration(BETA)" function in General Ledger.

Inventory Integration (Option) : If selected, the system will allow access to the "Inventory Integration" function in General Ledger.

Account Coding

Department Code Size : This field will define how many characters to allow for a prefix to the main Account code. It is commonly used to distinguish Branches or Departments that will share the same range of Account codes.

Main Code Size : This field will define how many characters to allow for the main Account code.

Sub Account Code Size : This field will define how many characters to allow for a suffix to the main Account code. It is commonly used to differentiate expense codes at a micro level that will be displayed as a single total on the main financial statements ( e.g. differentiating expenses for an individual vehicle).

GL Control Accounts

Suspense Totals : All accounts will be totaled into the "Suspense Totals" dummy account. All Posting and Totaling accounts must include an “Add to” account set and the account that will be at the top of the hierarchy will be the "Suspense Totals" account. This account will not print on a financial statement as it should always total to zero ( i.e. the sum of all debit and credit accounts must equal zero).

Suspense Posting : The "Suspense Posting" account is a “catch-all” account. Any transaction that will be posted to an invalid account will post to this account. Typically, the system should never have a transaction with an invalid code, therefore, it would be prudent to check this account for entries. This account will not print on a financial statement

Accts. Payable Tax : The tax portion of an Accounts Payable invoice or Credit Note will post to this account (i.e. “Input Tax").

Accts. Receivable Tax : The tax portion of an Accounts Receivable invoice or Credit Note will post to this account (i.e. “Output Tax").

Accts. Payable Bank : This account will be the default bank account for Accounts Payable invoices that are paid.

Accts. Receivable Bank : This account will be the default bank account for Accounts Receivable receipts. This account may be the same as "Accts Payable Bank".

Accts. Payable Control : This is the control account that will hold outstanding balances due to Suppliers. The total of this account should match the total for the Aged Trial Balance in Accounts Payable.

Accts. Receivable Control : This is the control account that will hold the outstanding balance due to Customers. The total of this account should match the total for the Aged Trial Balance in Accounts Receivable.

Retained Earnings : The End of Year Close-Off process will transfer profit or loss to this account when the P&L accounts are set to zero for the new year. Also, outstanding Purchase Orders will accrued to this account.

Inventory/Labor Integration Accounts

Both Inventory and Labor Integration are methods that allow the system to automatically generate the necessary transactions into General Ledger at various stages.

PO Accrual :

Material WIP :

Material Applied :

Material On Hand :

Material Cost of Sales :

Material Expense :

Material Adjustment :

Labor WIP :

Labor Applied :

Labor Cost of Sales :

Labor Expense :

Outside Service WIP :