Tax Jurisdictions

Updated March 30, 2022

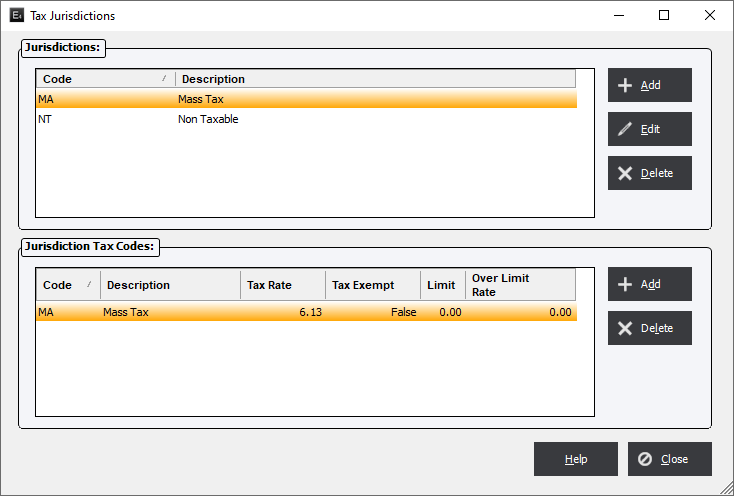

Tax Jurisdictions allow the system to create multiple tax rates, such as a state tax and a county tax for use in Accounts Payable and Receivable. Therefore, create Tax Codes first before creating any Tax Jurisdictions.

Tax Jurisdictions

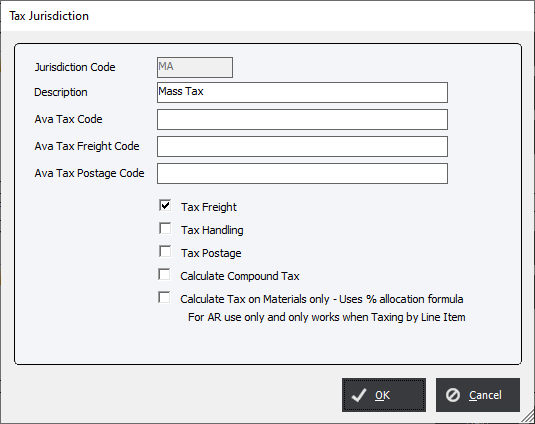

Click the Add or Edit button to create or edit a Tax Jurisdiction Tax Code.

Jurisdiction Code : 5 digit alphanumeric code.

Description : Explicit description.

Ava Tax Code : Map to Ava Tax integration code.

Ava Tax Freight Code : Map to Ava Tax integration code.

Ava Tax Postage Code : Map to Ava Tax integration code.

Tax Freight : Must be checked to apply tax on Freight charges.

Tax Handling : Must be checked to apply tax on Handling charges.

Tax Postage : Must be checked to apply tax on Postage charges.

Calculate Compound Tax : Allows for "Tax on Tax". For example if State Tax is 5% and Federal Tax is 2% than a $100 invoice would calculate as;

$100 x 5% = $105

$105 x 2% = $107.10

Calculate Tax on Materials only... (FOR AR ONLY) : When checked tax will only be applied on the material portion of an invoice.

|

NOTE: The above Tax check boxes will supersede any choices made in the individual Tax Codes. |

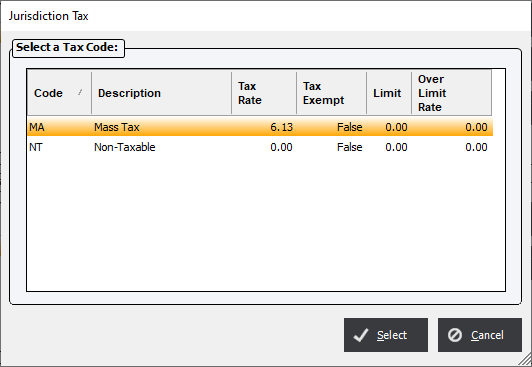

Add Jurisdiction Tax Codes

Click the Add button to select defined tax codes. Multiple Tax Codes can be associated with a single Tax Jurisdiction.