KB7913

Credit Card Fees

Updated May 8, 2024

Applies to : AR Module

The system allows the user to automatically create AR Accounting entries when accepting payments though the use of a credit card.

When using this feature it is important to note that it will ADD and PRINT the fees as a separate line item on an invoice.

For example;

|

Original Invoice Amount |

$100.00 |

|

Taxes (10%) |

$10.00 |

|

Total Value of the Invoice |

$110.00 |

|

Credit Card Fees (6%) |

$6.60 |

|

Total Amount billed to Credit Card |

$116.60 |

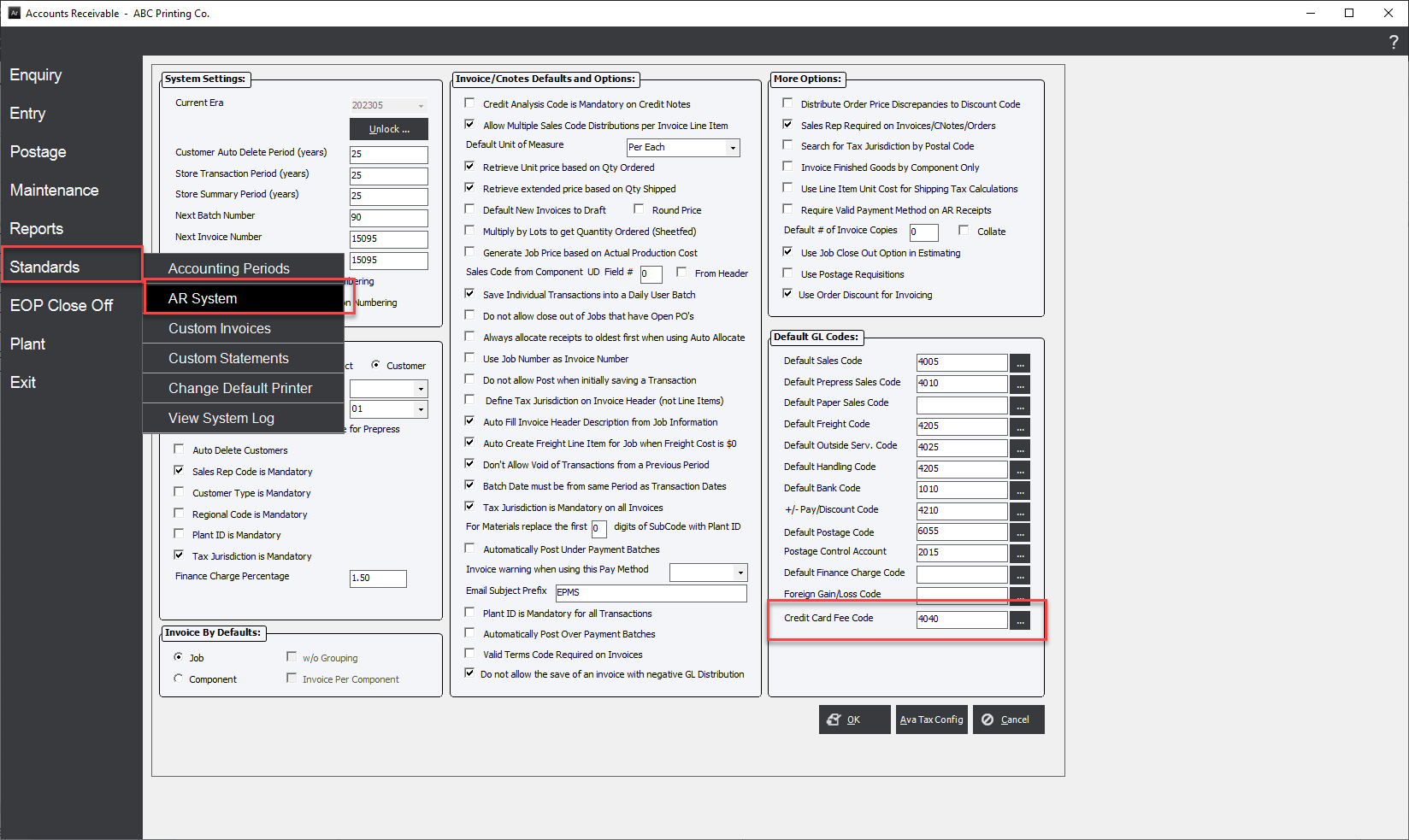

This feature requires additional setup in the AR System under the Standards menu in the AR Module and Payment Methods under the File menu in File Maintenance Module.

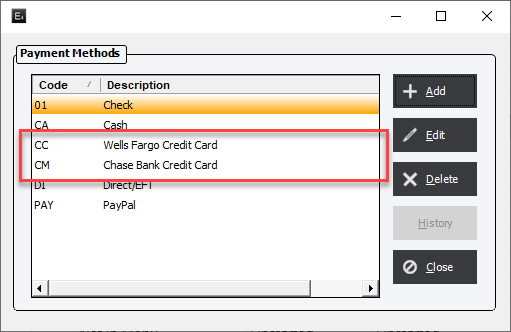

Set up a Payment Method table in Shop Standards.

The Payment Method must be setup with the Type set to Visa/Mastercard. With this type defined, the additional field CC Fee % will appear, allowing the user to save a credit card fee as expressed as a percentage.

The user could have multiple Payment Methods with each configured as a credit card pay method and each of them setup with a different CC Fee %.

AR System Standards Setup

Under the Default GL Codes section, in the Credit Card Fee Code field, the user must define which GL Code the credit card fees will have entries automatically made to if the Visa/Mastercard Payment Type is used.

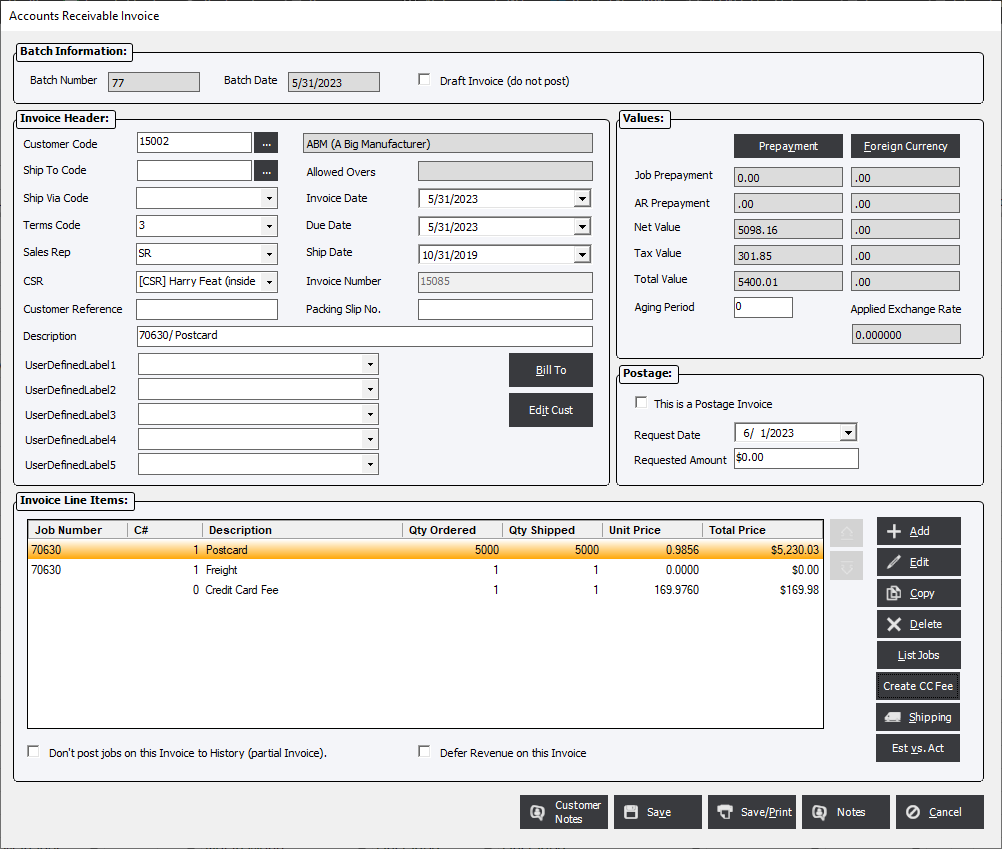

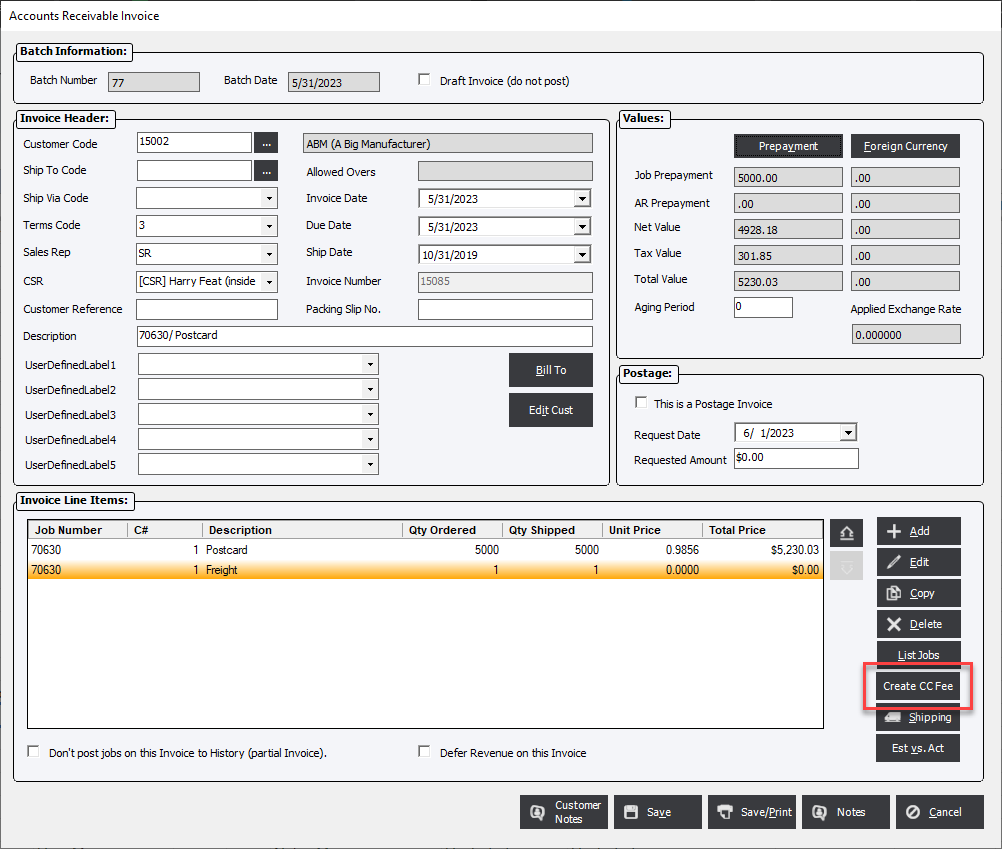

Generating an Invoice in AR Module

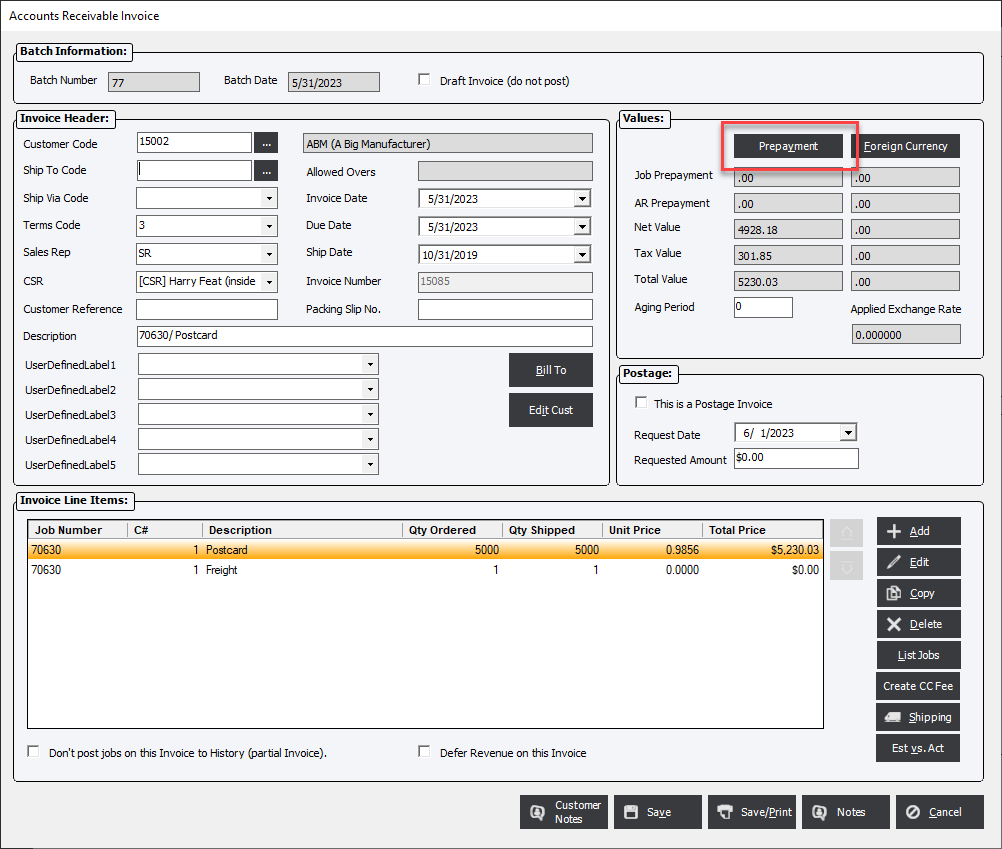

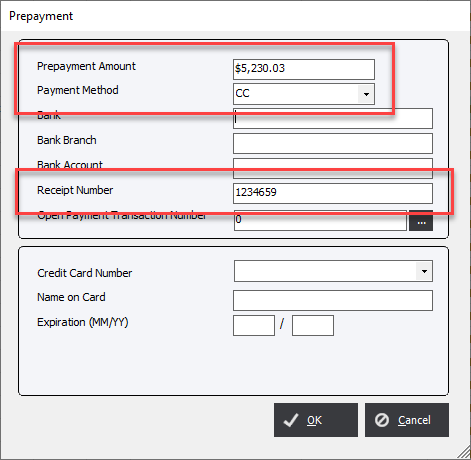

Credit Card Payments are defined within the Prepayment button on the invoice.

Fill in the following fields in the Prepayment screen.

Prepayment Amount : Enter the amount that will be charged to the Credit Card.

Payment Method : select the appropriate Credit Card Payment Method.

Receipt Number : Manually enter in the Receipt Number supplied when charging the Credit Card. If the user has entered in ANY value other than 0 (zero) in the Prepayment Amount field they will be required to enter a Receipt Number.

Special Note:

If the user chooses to leave the Prepayment Amount at 0 (zero) and chooses the Payment Method of a Credit Card with fees the system will NOT require the user to enter a Receipt Number. When the user calculates the fees by way of the Create CC Fee button the system will either use the Total Invoiced Amount or will not create an Invoice Line Item at all based on the choice below.

|

Note: It is not recommended to enter in the Credit Card Information but if the user elects to, the number will be encrypted when stored in the database. |

Creating the Credit Card Fee Line Item

Once the Prepayment information has been entered click the Create CC Fee button to add an Invoice Line Item.

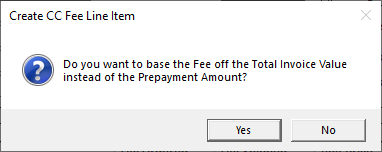

The user then has a choice on how the Credit Card Fee will be calculated.

If the user selects Yes : The Credit Card Fees will be calculated based on the Total Invoice Price including Taxes.

If the user selects No : The Credit Card Fees will be calculated based on the value entered into the Amount field in the Prepayment screen.

When the invoice line item is generated.

If the criteria is met to warrant creating a line item for the credit card fee THEN the following will occur;

-

Line Type – another line type code of C will be assigned.

-

Description with be Credit Card Fee.

-

Net Value – The calculate total will be equal to the Fee % X the Sum Total Value of all other invoice lines.

-

GL Sales Code – This will be pulled from AR Standards, The user is allowed to override the account number.

-

The CC Fee line item should be non-taxable regardless of Tax Code selected on the invoice.

-

The Invoice Line Item will NOT be assigned a Job Number and WILL be assigned Component 0 (zero).