Add Deductions

Updated September 5, 2024

Applies to : All Material Items and Finished Goods Items

When necessary, the system allows the user to manually enter Deductions to either a Material or Finished Goods item.

A Deduction may relieve (i.e. reduce) the inventory item in one of several ways.

Special Note for Finished Goods Items

|

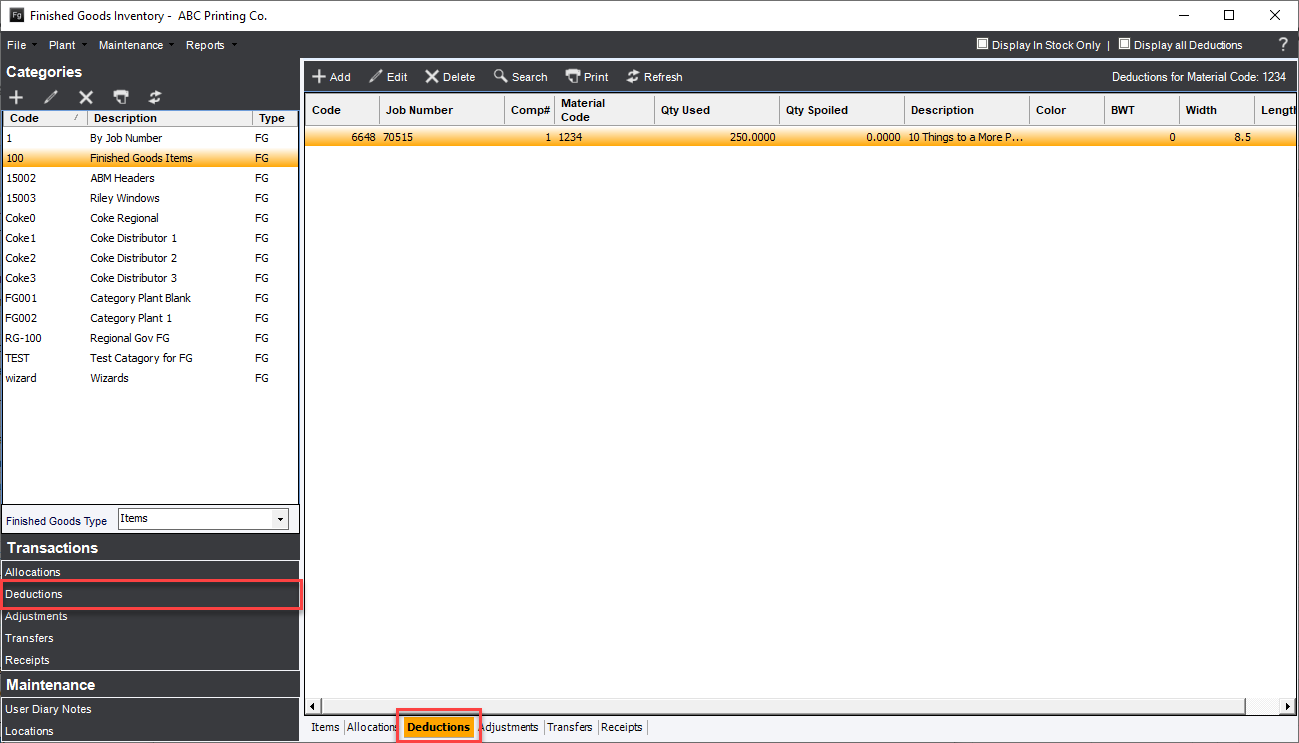

From the main Material or Finished Goods Inventory screen select the category then a specific item to make the manual Deduction to.

Then select the Deductions tab at the bottom of the screen or from the lower left menu.

Finished Goods Adjustment Screen

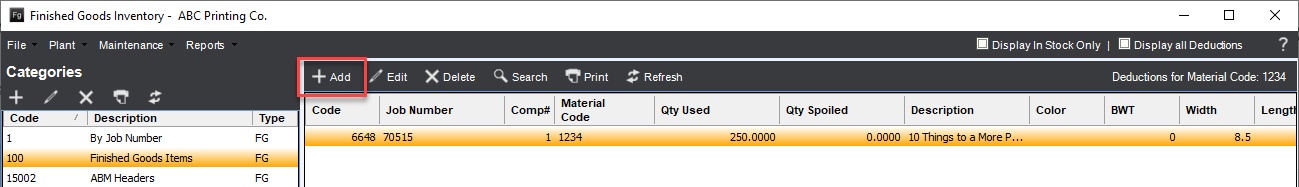

Next select the Add button at the top.

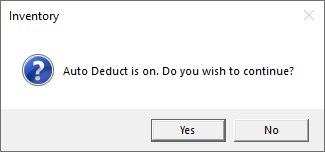

If the user has set the option Auto Deduct Inventory when Job is Completed to Yes then the system will display the following dialog.

If this option Auto Deduct Inventory when Job is Completed to No or if the user selects Yes to continue the user will continue to the Material Deduction screen.

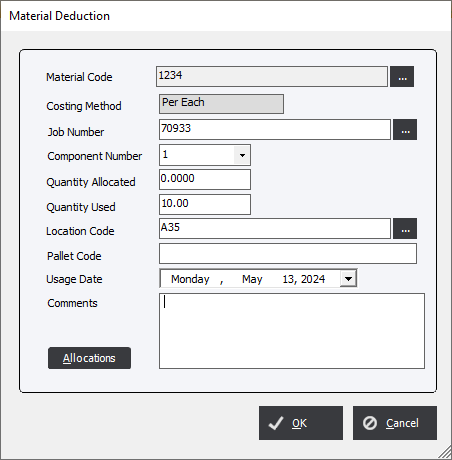

Material Code : Defaulted to the selected item but can be changed by clicking the ellipsis.

Costing Method : Taken from the item and cannot be altered.

Job Number : The Deduction usually will coincide with an Order but Deductions does not require a Job Number. The ellipsis allows the user to select from a Job List.

Component Number : If a Job Number is selected the Component Number will allow the user to select the specific Component Number for which to assign the Deduction.

Quantity Allocated : The amount of a item that is required from inventory to fulfill an Order.

Quantity Used : The amount of a item that will reduce the inventory for an item.

Location Code : The specific Location from which to make the Deduction.

Pallet Code : Informational.

Usage Date : The date that the Deduction took place.

Comments : Any comments that would help explain the manual Deduction for future reference.

Allocations : Allows the user to select from available Allocations to populate the screen. If the user selects one of the Allocations and completes the Deduction, the Allocation will be removed from the the Allocations List.